Overview of Goods and Services Tax (GST)

GST is similar to Value-added tax (VAT) in other countries and was implemented on 1 April 1994.

GST is an indirect tax (at 7% since 1 July 2007) and is applied to the selling price of applicable goods and services, and upon the importation of goods (as determined under the GST Act) by Singapore GST registered entities.

GST Input tax refers to tax paid or payable on purchase of goods or services from GST-registered suppliers or importing goods into Singapore.

GST output tax refers to tax collected for sales of goods or services in Singapore.

Below are some common questions we received from clients.

1. When should your company register for GST in Singapore?

You are required to self-assess your businesses quarterly if you should register for GST.

Compulsory GST registration

a. Under Retrospective View

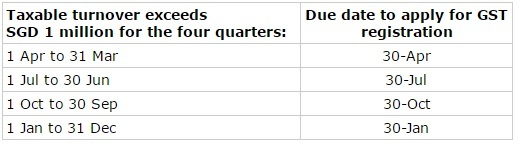

The company must register for GST when the taxable turnover is more than SGD 1 million (for the past twelve months ending March, June, September, and December).

b. Under Prospective View

You can reasonably expect that the taxable turnover will exceed SGD 1 million in the next twelve (12) months and the company should be registered by the 31st day from the date of the forecast.

If the company is late in the GST application, the effective date of GST registration will be back-dated to the date the company is liable to be GST registered.

Voluntary GST registration

The company may also elect to register for GST voluntarily even if its taxable turnover is not more than SGD 1 million.

You can find more information at “What should your business consider before going for GST voluntary Registration?“

Exemption from GST registration

You can apply for exemptions from GST registration if your business fulfils the following::

– More than 90% of total taxable supplies are zero-rated supplies; and

– If you are a GST registered business, the input tax incurred on purchases is higher than the output tax.

To apply for exemptions from GST registration, you must complete GST F2 form and submit it along with the required documents.

IRAS will notify you for the successful application.

If your application is not approved, you must register your company for GST.

2. As a GST Registered Businesses, what should the company do?

Once you register your business for GST with IRAS, the company must file accurate GST returns regularly and pay GST due on time.

IRAS has put in place many General GST Schemes to assist Singapore companies in conducting business in Singapore.

Below are the key requirements as a GST Registered Business :

a. Businesses must maintain proper accounting and business records for a minimum of five (5) years.

b. Tax invoices must reflect the business GST Registration number.

c. Tax invoices must display both GST-inclusive price and the GST-exclusive price at a noticeable area on the tax invoice.

d. For late filing GST returns or not filing, it is an offence with a fine up to SGD 5,000 and in default of payment, the incarceration term is up to a maximum of six (6) months.

e. For paying later or not payable GST due, businesses may pay the penalty.

f. For submission of incorrect GST returns, the companies may pay the penalty up to 200% of the tax undercharged, liable to a fine and an incarceration term.

g. For correction of errors (use GST F7 form) in the past GST returns, businesses have five (5) years from the end of the relevant accounting periods.

h. The company should inform IRAS on any changes in the business within 30 days (i.e. registered address, business name, change in ownership, and shareholders)

3. What is the GST registration procedure?

GST F1 form along with the required supporting documents (as in the IRAS document checklist) must be sent to IRAS.

For all partnerships and partners, a GST F3 form must be submitted together with GST F1 form.

Overseas registrants are expected to appoint a local agent and attach an official letter, along with the required application form.

a. For compulsory registration – the process takes approximately ten working days.

b. For voluntary registration – the process takes approximately one month.

Upon successful GST registration, the company will receive a letter from GST, and it contains the company’s GST number and the effective date of GST registration.

For your information, a GST F2 form is used for application for exemption from GST Registration.

4. How does the company claim GST input tax?

a. You may have incurred GST input tax when you import goods into Singapore or purchase from GST-registered suppliers. You can claim GST Input Tax if you fulfil all conditions for making a claim.

b. You should make the GST input tax claim in the same accounting period which matches the date on the source documents (tax invoice or import permit) or based on the “date” these details are posted in the accounting system.

c. GST input tax incurred on exempt supplies is not claimable unless it satisfies the De Minimis Rule.

d. Subject to certain conditions, you may claim GST input tax incurred before incorporation of the company and also before registering for GST.

e. You must repay GST input tax (previously claimed from GST Comptroller) if you do not make payment to your supplier within twelve months of the due date of payment.

5. What type of goods and services should the company charge GST?

a. If your business provides rebates (volume rebates) or discounts (prompt payment) to your customers, you should charge GST and account for GST.

b. Provision of services to an overseas customer – GST is usually at 0% (zero-rated) and is an international service if they fall within Section 21(3) of GST Act.

c. For any goods delivered or sold in Singapore, GST must be charged.

d. As part of your business strategy, you may absorb GST payable by your customer. In this instance, the amount of money you receive from your client is deemed as inclusive of GST.

e. You must pay the GST you collect (also known as output tax) to IRAS.

f. You can claim GST you incur (also known as input tax) on these business expenses.

6. When should the company submit GST Returns?

a. You must submit the GST return to IRAS within one (1) month after the end of the quarter. For example, GST Return Q2 covers the periods from April to June (three months), and you must submit the GST return before the end of July.

b. You must report both output tax and input tax in the quarterly GST return.

c. The net GST payable or refund from IRAS is the difference between the output tax and input tax.

d. GST F5 form has thirteen boxes to complete.

e. In the GST F5 form, all figures reported must be in Singapore currency (SGD).

7. What type of accounting records should the company maintain?

Please continue to read “Record Keeping Guide For GST-Registered Businesses“.

8. Can the company request for a change in GST accounting periods?

a. If there is a change in the financial year-end, the company may write to IRAS to request a change in the GST filing frequency.

b. If the company’s financial year end does not end on the last day of the calendar month, the company may write to IRAS to apply for special accounting period GST filing.

9. Can the company cancel its GST registration?

Please continue to read “Cancelling GST Registration“.

Should you need assistance or would like to find out more about Learn More in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our GST Team will contact you.