Overview of Singapore Tax Structure

Government collect taxes to develop Singapore into a better, robust and vibrant economy. Inland Revenue Authority of Singapore, commonly known as IRAS, administers the corporate regime in Singapore.

IRAS levies income tax on income earned by companies conducting business in Singapore. Compliance with Income Tax Act is a complex matter, and all Singapore companies are required to file tax returns on time.

In the event of non-compliance, the company may incur civil (financial), criminal (imprisonment) or penalties.

Below are some questions on Corporate Tax we gather from our clients.

1. What is the company’s tax year or year of assessment (YA)?

For the financial year ended 31 December 2020, the tax year is YA 2021, and the filing due date is 30 November 2021.

For the financial year ended 31 March 2020, the tax year is YA 2021, and the filing due date is 30 November 2021.

2. What is the company’s tax reference number?

The company’s tax reference number is the company’s Unique Entity Number (UEN) number (i.e. you can refer to the first page of the ACRA biz file).

3. What financial year end should we set for the company?

The directors should discuss with company secretarial team and decide on this matter. Do notify IRAS or the appointed tax agent once the company determines its financial year-end.

4. The company is dormant during the financial year. Is the company required to file tax returns with IRAS?

Yes. It is compulsory for all companies to file tax returns to IRAS notwithstanding that the company is dormant during the financial year.

5. The company is in a loss position during the financial year and qualified for a waiver to file ECI. Is the company required to file final tax returns with IRAS?

Yes. It is compulsory for all companies to file ECI and tax returns (Form C or Form C/S) to IRAS.

6. The company filed its ECI 3 months after the financial year-end. Is the company required to file the tax returns with IRAS?

Yes. It is compulsory for all companies to file tax returns (Form C or Form C/S) to IRAS even if there is no change in the chargeable income reported in the ECI and the tax returns.

7. The company held its AGM and filed its Annual Returns with ACRA. Is the company required to file tax returns with IRAS?

Yes. Annual Returns (ACRA) and Tax Returns (IRAS) are two separate statutory filings to the government agencies. It is compulsory for all companies to file tax returns (Form C or Form C/S) to IRAS.

8. What documents should the company maintain to support its tax returns?

The company should maintain copies of its sales invoices, payment vouchers, bank statements, receipts, invoices, bookkeeping records, general ledgers, financial statements and tax computations (including signed contracts or agreements, etc.) for five years from the relevant year of assessment (YA).

For the financial year ended 31 December 2020 (YA 2021), the company should keep its accounting records up to 31 December 2025.

For the financial year ended 31 March 2020 (YA 2021), the company should keep its accounting records up to 31 December 2025.

9. What is a tax computation? Is this compulsory to prepare before the company files its tax returns?

A tax computation is a statement which documents the basis of tax adjustments to the company’s accounting profit before tax to arrive at its chargeable income.

The tax computation should include income (taxable and non-taxable), expenses (deductible and disallowed), donations, capital allowances, further deductions and carry forward business losses.

Companies should prepare its annual tax computations before filing the Form C-S or Form C with IRAS. IRAS may request for copies of the tax computation and its supporting schedules during an audit.

10. Should the company hire a tax agent to handle its corporate tax matters?

Companies should seek advice from Singapore tax professionals on the company’s tax matters. The professional accounting firm provides compliance tax services to many Singapore companies, keep pace with changes in Singapore tax laws about tax exemption schemes, tax rebates, tax incentives and government grants.

11. What forms should the company submit to IRAS?

All Singapore incorporated companies are required to submit these forms to IRAS on a yearly basis:

1. Estimated Chargeable Income (ECI) – the due date is within three months after the end of the financial year unless the company does not need to submit ECI.

2. Form C or Form C-S – the due date is on 30 November (for paper filing) and 15 December (for electronic filing) of the year of assessment.

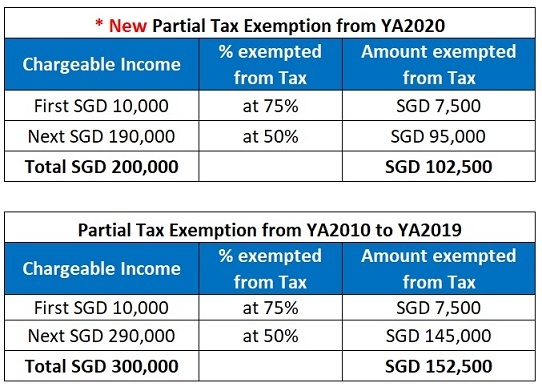

12. What are the tax exemptions for Singapore companies?

All Singapore incorporated companies (except for new start-up companies in their first three consecutive tax year of assessments and Singapore Branch) enjoy Partial Tax Exemption as provided below.

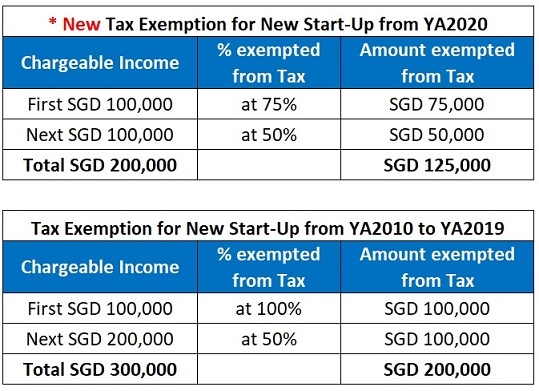

13. What are the tax exemptions for New Start-Up Singapore companies?

The government introduced the start-up companies’ tax exemption scheme in the Year of Assessment 2005.

For qualifying Singapore incorporated entities, in their first three consecutive tax year of assessments, tax exemptions are provided below.

Should you need assistance or would like to find out more about Tax Services in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our tax advisor will contact you.