Overview of Singapore Tax Structure for Individuals

In Singapore, collected taxes are used to develop the country into a robust, stable and dynamic economy.

Inland Revenue Authority of Singapore (IRAS) regulates the tax framework and administration in Singapore.

Income tax is levied on income earned by Singapore tax resident individuals.

All Singapore tax resident individuals must comply with the Income Tax Act and file accurate tax returns annually.

An individual is deemed as a Tax Resident in Singapore for a specific YA if

1. the individual is a Singapore Citizen or a Singapore Permanent Resident who lives in Singapore;

2. the individual is a foreigner who work in Singapore (excludes those who are the director of a company) for 183 days or more.

Otherwise, the individual is treated as a Singapore non-resident for tax purposes.

1. When is an individual regarded as tax resident in Singapore?

For foreign workers with work pass that is valid for at least a year, IRAS treats you as a tax resident upfront for tax purposes.

You are a Singapore tax resident if you stay or work in Singapore for

– at least 183 days in a calendar;

– at least 183 days for a continuous period (over two years); or

– continuously for three consecutive years.

Your earned income is subject to tax based on the below progressive resident tax rates (refer to FAQ#13) and may claim tax reliefs.

The above does not apply to professionals, directors of the company and public entertainers.

2. When is an individual regarded as non-tax resident in Singapore?

You are a non-tax resident if you stay or work in Singapore for 61 to 182 days in a calendar.

The tax amount on the employment income will be the higher of 15% or progressive tax resident rates.

If you work for 60 days or less, there is no tax on your short-term employment income.

In additions, directors’ fees and other income are subject to a tax rate of 20%, and you do not have tax relief benefits.

The above does not apply to professionals, directors of the company and public entertainers.

3. What does employment income include?

Employment income includes your monthly salary, allowance, bonus (variable, fixed, annual or performance-based) and employment benefits (i.e. stock options and housing).

Income derived outside Singapore, bank interest income and dividend from Singapore companies are not subject to tax.

4. I received rental income. Should I report in my tax returns to IRAS?

For your property in Singapore, you should declare rental income received (for the calendar year) in your income tax return.

You can claim as the tax deduction for qualifying rental expenses incurred on your Singapore property.

5. As an individual, what is the tax period for a Year of Assessment (YA)?

For personal income tax, you should report your employment income and other income based on the preceding calendar year.

For income earned between 1 January 2018 to 31 December 2018, this is referred to as Year of Assessment 2019 or YA 2019.

You should file your YA 2019 personal income tax returns not later than 15 April 2019.

6. I heard that personal reliefs could help save tax. What are personal reliefs?

Personal reliefs are the deductions against your earned income, and these can help you to save tax.

Tax reliefs are allowable to Singapore tax resident and subject to meeting to qualifying conditions.

For illustrations, please view the information published at IRAS.

7. What are the common filing mistakes (for Employees)?

You can find the “common filing mistakes for employee” illustrations at IRAS.

– Not filing tax returns

– Wrong declaration of income

– Claim incorrect reliefs

– wrongful claim for CPF contributions (applicable to Self-Employed)

– Submit irrelevant documents to IRAS

– Did not click “submit” button to complete the submission of income tax return online

– Errors in declaration

8. What are the common filing mistakes (for Self-employed)?

You can find the “common filing mistakes for Self-employed” illustrations at IRAS.

– Wrong declaration of trade income under Employment or Other income.

– Self-declaration by Property Agent and Insurance Agent

– Declaration of estimated trade income and business expenditures

– Incorrect statement of Partnership salary, income and expenses

– Wrongful claim of CPF relief

9. I have filed my tax returns. How do I check the filing status?

You can log into myTax Portal and select “view filing status”.

For more information, you can read the illustrations at IRAS.

10. I have received my tax bill (Notice of Assessment). What should I do next?

You should check the Notice of Assessment (NOA, online or hard copy) and make payment to IRAS within 30 days from the date of NOA.

Should you disagree with the NOA, you should write to IRAS within 30 days stating your reasons or you can submit your objection online via the “Object to Assessment” service at myTax Portal.

11. What are taxable and non-taxable incomes?

All money received (from employment, trade, business, profession, vocation, property, investments or other sources) earned in or derived from Singapore is subject to income tax (unless specifically deemed as non-taxable income in the Income Tax Act).

In most circumstances, overseas income received in Singapore are not taxable (which include the foreign sourced dividend, foreign branch profits and foreign service income).

Overseas income is taxable in Singapore when it is received through a Singapore Partnership or income from your employment overseas is part of the Singapore employment.

12. What type of expenses can an individual claim?

An individual can claim tax deductions for certain expenses (employment, business and other expenses – allowed under the Income Tax Act) incurred in earning the income.

Tax relief and rebates are available for deduction against taxable income for Singapore tax residents who meet the qualifying conditions.

To promote specific social and economic objectives, there are some tax reliefs and rebates for particular groups of taxpayers.

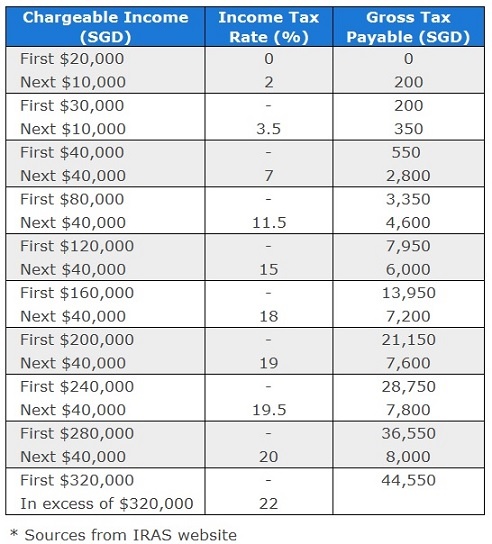

13. What are the Resident tax rates?

From YA 2017, the following are the progressive Resident Tax rates.

14. What are the Non-Resident tax rates?

Your personal tax liability is dependent on the status of tax residency.

For foreign employees issued with a work pass (valid for at least one year), you will be treated as a tax resident upfront.

The non-resident employment income is taxed at a flat rate of 15% or similar to the above progressive Resident Tax rates (whichever give the higher tax amount).

From YA 2017, the non-residents’ tax rates (for example, director’s remuneration, professional fee, SRS withdrawal, property rental income and certain earnings) are revised from 20% to 22% to maintain parity between the non-resident tax rates and the resident individuals’ top marginal tax rate.

Certain incomes (subject to conditions) are at a reduced withholding tax rate of 10% to 15%.

15. What are the filing due dates?

All taxpayers are required to file their tax returns (income is assessed on the calendar year basis):

1. Electronic Filing – latest by 18 April

2. Paper Filing – latest by 15 April

16. Can an individual request for a filing extension?

Taxpayers must send in their application (before 31 March) through email, fax or post and include the following:

1. Full name as per NRIC or Passport;

2. Tax reference number;

3. Indicate clearly the reason(s) for the request; and

4. An Estimated Chargeable Income.

17. What are the penalties for late or non-filing for tax returns?

IRAS can take the following actions on individuals:

1. Levy a late filing fee;

2. Issue an Estimated Notice of Assessment (NOA);

3. Issue a summon to the Individual to attend Court on a specified date; and/or

4. Issue a Warrant of Arrest to the Individual.

Should you need assistance or would like to find out more about the Personal Tax services in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our business advisor will contact you.