Extension of Compliance Filing Deadline For Singapore Companies

On 4 April 2020, local businesses and taxpayers feel relieved when Singapore regulatory bodies, IRAS and ACRA, announced the extension of deadlines for tax filing, Annual Returns (AR) filing and holding of Annual General Meetings (AGM) to support Singapore businesses during this COVID-19 pandemic.

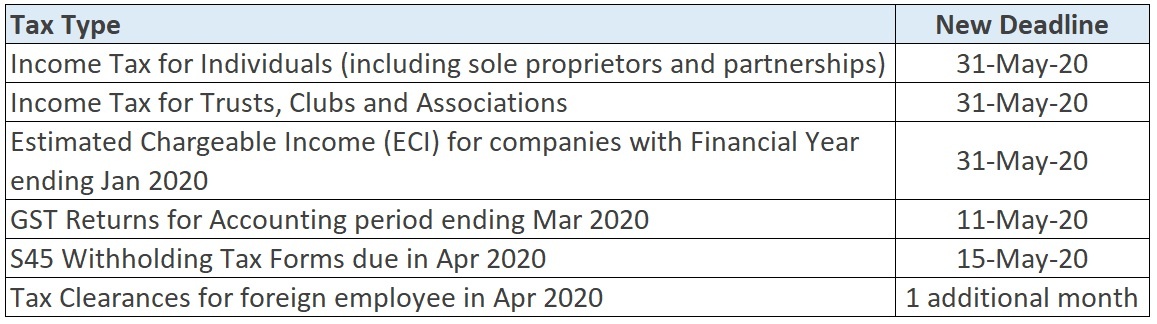

IRAS – Extension of Deadline to file Tax

IRAS extends tax filing deadlines, taxpayer counter services by appointment only.

Book your appointments in advance with IRAS

In the event that business owners need face to face tax filing assistance, they must book an appointment at least two (2) working days in advance before visiting the e-Filling Service Centre (EFSC), and Taxpayer and Business Service Centre (TBSC) at Revenue House (IRAS).

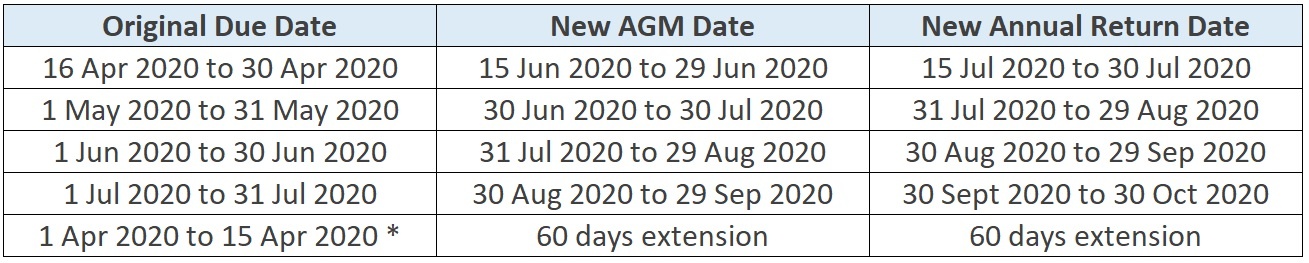

ACRA – Extension of Deadline to Hold AGMs and File Annual Returns (AR) for non-listed and listed companies for 60 days

Extension of Deadline for Holding Annual General Meetings and Filing Annual Returns

* ACRA will not impose penalties on listed and non-listed companies whose AGMs are due during this period. Singapore companies do not need to apply for the extension of time.

Have questions? We are happy to assist you and do reach out to our company secretarial team.