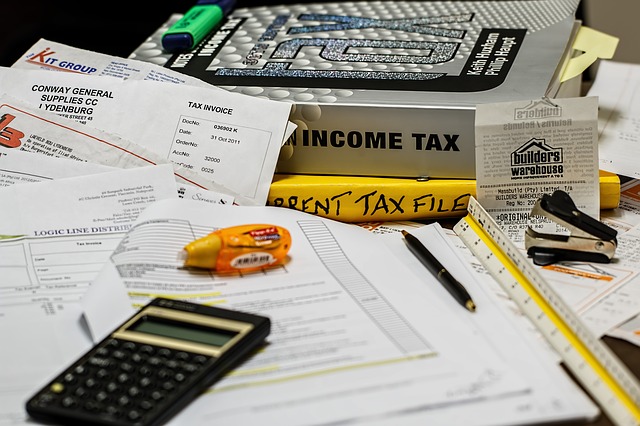

The tax accounting department often faces significant challenges when it comes to the management of financial restatements due to errors and tax accounting issues and increased regulatory and scrutiny of tax-related balances and disclosures.

There is also the pressure of meeting the quarterly GST filing, ECI filing three months after financial year-end and annual financial reporting and corporate tax timelines.

Hence, companies often need to employ skilled tax accounting resources to manage their tax functions and related matters, which can prove to be hefty on the firm’s expenses, especially for small companies and startup ventures.

To avoid all this, you can outsource your company’s tax accounting function to the corporate tax accounting expertise who offer these services as an outsourced tax solution.

What Do You Get From Outsourcing Your Tax Accounting Function?

By outsourcing to our Learn More team, you will not need to hire tax accountants and manage them as full-time employees in your company, saving you a lot of money and time.

Not only that, but you will also get expert advice on the following too.

1. Tax Optimization

Every business, shareholder and a start-up entrepreneur are different. An equally unique planning strategy is provided based on your business and needs.

2. Tax Advice

A strategically drawn approach is a must when it comes to tax optimisation.

Developing plans and tactics with proper administration and systems to support, operate, track, document and follow through the tax optimisation are some useful approaches.

3. Corporate Tax Planning and Filing of Tax Returns

Tax planning professionals work with experts and other specialists to provide tax services to Singapore companies.

This process helps your organisation enhance cash flows and increase gross tax margins, which in turn can enable you to give a yearly bonus to your employees.

4. Employee Remuneration

These strategies can help your staff reduce or even eliminate corporation tax and income tax and national insurance.

This process can contribute to saving some money.

5. Business Exit Strategies

You might want to develop a good business exit strategy in case you want to go for a profitable exit.

Many start-up companies and small firms prefer this method to gain huge profit with a comparatively less capital.

Advantages of using Outsourced Tax Service Team

Outsourcing your tax function will mean your business will have a more paperless workflow of tax, where the taxpayer documents will be scanned and uploaded into the website.

You can review your tax returns online in an efficient and organized manner. You can easily make updates in your company’s profile online.

This process ensures security and privacy of your data and respective source documents.

A technical tax team will assist you to understand about corporate tax systems and to help you prepare the necessary tax returns for filing with IRAS.

You will have more time for your business and left the tax agent to handle the tax obligations and tax computation.

Should you need assistance or would like to find out more about Learn More in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our business advisor will contact you.