What taxes should an Australian entrepreneur consider when setting up a company in Singapore?

Singapore transparent tax system is among the reasons why Australian entrepreneurs choose Singapore to grow their venture or start a business.

Apart from easy access to capital, Singapore offers comprehensive trade agreements and incredible tax frameworks.

So, if you are planning to explore the business opportunities and what taxes should you consider before setting a Singapore company, then continue reading.

Benefits of Singapore Corporate Tax System

Not only do the corporate tax rates are simple, but they are also fairly low and transparent. The rate for corporate tax is about 17% flat for local and foreign entrepreneurs.

Interestingly, the Singapore government is supporting start-ups companies through tax exemption scheme during the first 3 years upon the incorporation.

We have more than 21 free trade agreements along with more than 60 avoidance of Double Taxation Agreements (DTA). The Singapore government facilitates the trading and business across borders and aims to minimize tax barriers.

Another reason why Singapore is a perfect destination to start a business is that the tax system offers lower withholding taxes. Also, there is no dividend and capital gains tax.

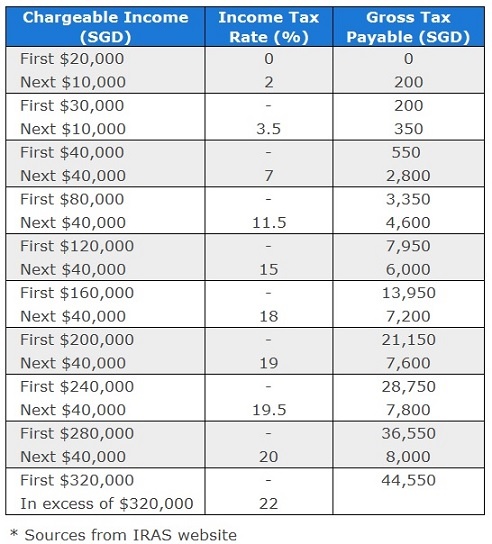

As for the personal income tax structure, the marginal rates range is between 0 to 22%.

Australia and Singapore Corporate Taxes Comparison

Despite the similarity in the tax structure, the corporate taxes of Singapore come at lower rates. Both Australia and Singapore have a Double Taxation Agreement.

This means that entrepreneurs are protected from getting taxed twice on similar income.

In Australia, entrepreneurs have to face 5 to 30% unfranked dividends while in Singapore, dividends are tax exempt.

There’s no tax on capital gains in Singapore, while in Australia, entrepreneurs have to pay 30% capital gains tax.

Singapore Start-Ups Tax Exemptions is Available

The Singapore government has the Start-Up Tax Exemption which offers a special tax exemption for new start-ups. This tax exemption is for the first three tax assessment year.

That is to promote entrepreneurship while helping entrepreneurs grow their start-ups.

Qualifications for the Singapore Start-Up Tax Exemption

The start-up exemption is made available to all start-up companies except companies with these 2 principal business activities:

- Investment holding as to principal activity;

- Developing properties are for investment, sale, or both as principal activity

Eligible start-ups must meet all the following conditions to qualify for the Start-Up Tax Exemption:

- No more than 20 shareholders for that tax assessment year (YA);

- The start-up must be a company incorporated in Singapore;

- The start-up must be a tax resident for that YA; and

- If one of the shareholders is a corporation, there must be another individual shareholder who holds at least 10% shareholding.

Other Business Taxes

Though Singapore does not declare dividends and capital gains to be taxable, entrepreneurs might encounter the Learn More (GST).

The company should register for GST if their turnover grows more than SGD 1,000,000.

If a business is registered in GST, entrepreneurs have to charge GST on the supply.

On the positive side, they can claim the GST suffered on the purchases. Besides, if the companies mainly export goods abroad, they can apply for GST registration exemption.

When and How to Submit Taxes

In Singapore, taxes are filled annually by November 30 with IRAS.

Entrepreneurs have to submit the previous year’s income report.

For example, you need to submit a report for the financial year ending in 2019 income on or before 30 November 2020.

You can ask for tax professional help from Singapore accounting firm and they can also provide advice in terms of tax exemptions qualification.

To give you an idea on when you can submit corporate income taxes, consider the table below:

|

Financial Year End (FYE) |

Tax Basis Period |

Year of Assessment (YA) |

Corporate Tax Filing Deadline |

| 30 September | 1 October 2017 to 30 September 2018 | YA 2019 |

30 Nov 2019 |

| 31 December | 1 January 2019 to 31 December 2019 | YA 2020 |

30 Nov 2020 |

Is It Possible to Lose the Company’s Singapore Tax Residency?

Yes, once the IRAS discovered that the entrepreneurs’ control and management of the company are happening elsewhere.

The board of directors is required to create and meet strategic decisions while in the country.

If you lose your Singapore tax residency, then you will not get the most benefits and exemptions.

Good thing, residency is being evaluated every year. Meaning, you can submit an application again the following year.

What Personal Taxes Should I Pay After I Move to Singapore?

If you move to Singapore, the personal income tax rate that you need to pay is progressive from 0% to 22%.

Get Singapore Tax Compliance Services Now!

Are you ready to explore incredible business opportunities in Singapore?

Then, our tax experts will be here to help you.

Contact our Learn More team today to get more information and get a quote!