What is ECI for Singapore companies?

ECI (Estimated Chargeable Income) is to estimate the business’s assessable income for a Year of Assessment (YA).

All businesses (including well established or start-ups) are required to file ECI to IRAS within three (3) months from the end of their financial years.

Companies with zero income or nil chargeable income in the previous YA are also required to complete the ECI as ‘nil’ unless the companies qualify for certain administrative concessions.

How to file an ECI?

The Budget 2016 made mandatory ECI e-filing from Year of Assessments 2018 to 2020.

1. From YA 2018, only companies with revenue more than SGD 10 million in YA 2017 are required to e-file their ECI.

2. From YA 2019, only companies with revenue of more than SGD 1 million in YA 2018 have an obligation to e-file their ECI.

3. From YA 2020, all businesses are required to e-file their ECI.

For YA 2017, IRAS offers two flexible modes for filing estimated chargeable income (e-File and Paper file).

Businesses can either file ECI online via e-service my Tax Portal or submit an ECI form (hardcopy).

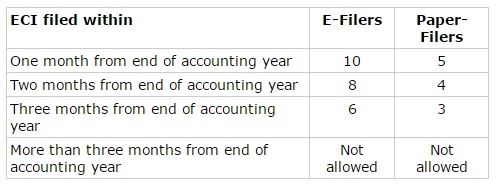

To encourage more e-filing, IRAS allows more instalments to early e-filers than early paper-filers as shown in the table below:

To enjoy the maximum number of instalments, the company must e-file by the 26th of each qualifying month.

For the paper file, the company must send the ECI Form to IRAS by the 24th of each qualifying month.

Who are exempted from filing the ECI?

To assist businesses in reducing compliance costs, IRAS revised the ECI waiver criteria as follows:

For company’s financial year ends on or before June 2017

1. Annual revenue is not greater than SGD 1 million for the financial year; and

2. * ECI is NIL

For company’s financial year ends on or after July 2017

1. Annual revenue is not greater than SGD 5 million for the financial year; and

2. * ECI is NIL

* This refers to the amount before deducting the tax-exempt amount under the tax exemption scheme for new start-up companies.

What should you keep in mind while filing the ECI?

1. To obtain additional instalments by e-filing the ECI early.

2. If you have paid less ECI than the actual chargeable income (CI) reported, the additional tax must be paid within 30 days.

When the companies receive the Notice of Assessment (NOA), IRAS may query the company to provide an explanation if there were a difference in the ECI reported earlier and the chargeable income (CI) reported.

If you have paid excess tax, IRAS would automatically refund the money to you.

In cases of non-availability of audited financial statements, the company’s management accounts can be used for the declaration of the revenue amount.

If the amount of revenue in the audited financial statements is different from that mentioned in the ECI form, you are not required to revise it.

What are the advantages of filing ECI on time?

1. Companies who submit their ECI early may opt to pay their taxes in instalments.

2. Companies who e-file and file ECI on time enjoy a higher number of instalments.

Should you need assistance or would like to learn more about the Tax Services in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our tax advisor will contact you.