Amendments to Companies Act and Limited Liability Partnership Act

A review of the existing Companies Act and Limited Liability Partnership (LLPs) Act was conducted to ensure that the Singapore corporate regulatory system remains stable and continues to support developments and improvements for businesses and investors.

These amendments provide more transparency in the ownership and control of business legal entities and thus reduce the misuse of these entities for illegal purposes to better meet the recommendations from the Financial Action Task Force (FATF) to combat money laundering activities.

>> Effective From 31 March 2017

1. More transparency in beneficial ownership of Singapore Companies and LLPs

a) Companies, foreign companies and LLPs should maintain a public register of beneficial owners (Registers of Controllers), members and nominee directors.

A controller or a beneficial owner is defined as a legal entity or an individual who owns more than twenty-five per cent (25%) interest in or has ultimate effective control over another legal entity.

Singapore companies should have the procedure in place to ensure they comply with the statutory requirements.

Companies are required to have proper and adequate procedures to obtain and update data or information on the legal entity’s controllers or its ultimate beneficial owners which include sending notices to potential individuals who maintain these details.

Companies, foreign companies and LLPs must declare to ACRA the location of these registers when filing the annual returns. These records must be made available upon request by public agencies.

b) For new-incorporated companies, foreign companies and LLPs, these registers are required to be in place within 30 days from incorporation.

c) For existing companies, foreign companies and LLPs, these registers are required to be in place within 60 days from 31 March 2017.

d) Singapore-listed companies, government agencies & statutory boards and Singapore financial institutions are exempted.

ACRA will provide further guidance which includes samples of notice that Singapore entities can send to obtain key information for the Register of Controllers from their directors, shareholders and any relevant individuals.

Updated on 7 September 2018 – Companies should take necessary measures to adequately identify the their registrable controllers, and must minimally send out an annual letter or notice to every member and every director (registered with ACRA) once a year. (Singapore Companies Act Section 386 AG).

In the event that the Companies are not able to perform the above, the Companies should send an email to ACRA for assistance.

On 29 October 2014, Institute of Singapore Chartered Accountants (ISCA) issued EP200 and it is effective from 1 November 2014.

EP200 is applicable to all professional accountants and professional accounting firms in Singapore. All ISCA members are required to comply with all EP200 requirements.

2. Record keeping for wound up and struck off entities

Liquidators of wound up companies and LLPs must retain accounting and beneficial owners’ records for 5 years. Option for early destruction of documents option is removed.

Officers of struck off companies and LLPs must retain accounting and beneficial owners’ records for 5 years.

3. Inward re-domiciliation system (similar to the change of corporate citizenship)

Singapore introduces an inward re-domiciliation system which permits a foreign corporation to transfer its registration from its original jurisdiction to Singapore (i.e. to relocate its regional or worldwide headquarters to Singapore) instead of incorporating a new legal entity in Singapore.

The re-domiciled entity will become a Singapore company and require to comply with the Singapore Companies Act.

4. Common seals

It is now optional to use common seals for companies and LLPs for execution of documents.

>> Effective From 31 August 2018

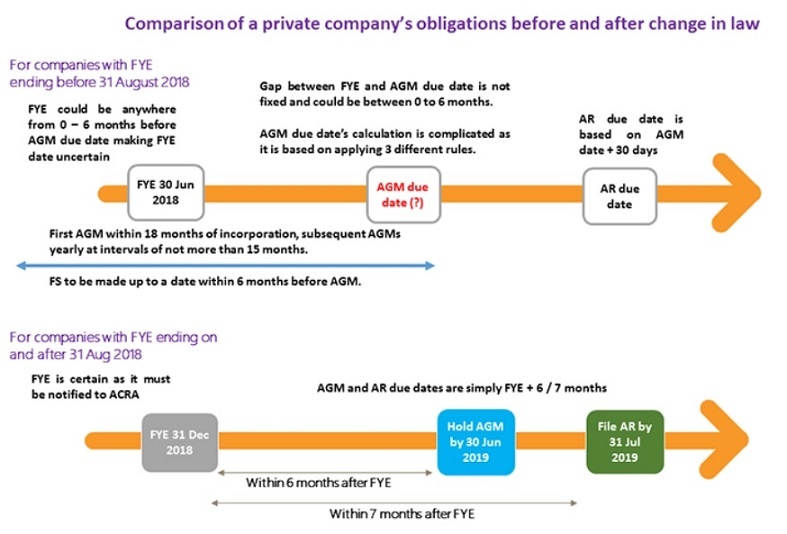

1. Holding of AGMs

Listed companies should conduct AGM within 4 months after the financial year-end.

Non-listed companies should conduct AGM within 6 months after the financial year-end.

2. Filing of Annual Returns (AR) to ACRA

Companies should file their Annual Returns (AR) within 5 months (for listed companies) and within 7 months (for non-listed companies) after their financial year end.

The company should conduct AGM first, then file ARs with ACRA.

3. Introduce laws to regulate the change in companies’ financial year end

Safeguards are put in place to prevent Singapore companies from arbitrarily changing their financial year end.

Companies should seek approval from ACRA if:

– the change in the financial year end result in a financial period of more than 18 months,

– there was a change in financial year end within the last five years,

– the companies have an unusual reporting financial year period (i.e. 52 weeks’ closing).

a) Existing companies

Before 31 August 2018, existing companies should update their financial year end with ACRA, otherwise the last financial year will be the companies’ next financial year end (in the future).

b) Newly incorporated companies

For newly incorporated companies, the first financial year end (default by law) is 12 months from its date of incorporation. Companies should notify ACRA to change their first financial year before or after 31 August 2018.

4. Holding AGMs for Private Companies

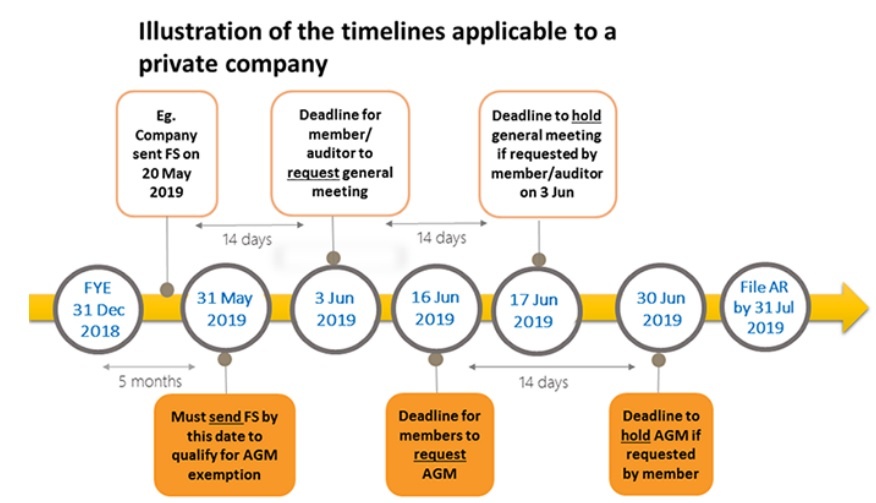

Private companies need not conduct AGM when all members approved a resolution via an Extraordinary General Meeting (EGM) to waive holding the AGM. There are no changes to this requirement.

In addition, private companies need not conduct AGMs if:

– they send their financial statements to their members within 5 months after the financial year end;

– no member requests to hold AGMs within 14 days before the last day of the sixth month after the financial year; and

– no member or auditor requests to hold AGMs within 14 days after the company sends out the financial statements.

In the event that the private companies receive such requests, the companies should hold the AGM within 6 months after the financial year end and file Annual returns within 7 months after the financial year-end.

Should you need assistance or would like to find out more about Company Secretarial services in Singapore, please send an email to Contact@AccountingSolutionsSingapore.com, and our business advisor will contact you.