IRAS e-Tax Guide 6th Edition published on 10 August 2021

Transfer pricing concerns the prices levied in the business transactions with related parties. Generally, a transaction (between two unrelated parties) are conducted at a price approximating to the market price. For related parties, this may not be necessary. As such, it is important that the price recorded in the related party transaction approximates to the market price.

IRAS provides transfer pricing guidelines for Singapore business entities on the

1. Application of the arm’s length principle in conducting business transactions with related parties;

2. Application of the arm’s length principle for certain business transactions (for example related party loans & services);

3. Maintenance of proper and up-to-date Transfer Pricing (TP) documentation; and

4. Facilities provided under tax treaties.

IRAS may perform an audit of the related party transactions (RPT) to verify if the price is reflective of the prevailing market prices.

In the event that the RPT is not at arm’s length and the Singapore taxpayer reports a lower profit to IRAS, IRAS may upward adjust Singapore taxpayer’s profit to reflect the arm’s length transactions.

Reporting of Related Party Transactions

With effect from YA 2018, in the event that the reported RPT in the audited financial statements (for the calendar year ending in 2017) exceeds SGD 15 million, Singapore companies must complete the Reporting of RPT Form.

The reported RPT value refers to the aggregate sum of the RPT items (line-by-line items) in the Profit or Loss Statements, the year-end loans and non-trade balances.

Related Parties Transactions should reflect independent pricing

When transacting with related parties, the pricing may not reflect the prevailing market conditions due to an absence of independence on the commercial and financial relationships.

As such, the taxable profits and liabilities of related parties may be distorted, especially if they conduct business in different tax jurisdictions.

The related parties may derive a tax advantage as a group as they may not be paying the correct tax amounts to the respective tax authorities.

IRAS applies the internationally endorsed arm’s length mechanism to ensure that transactions with related parties reflect independent pricing.

For non-compliance and understatement of profits, IRAS will upward adjust the profits as stipulated in the Income Tax Act.

When does the company require to prepare a Transfer Pricing Documentation?

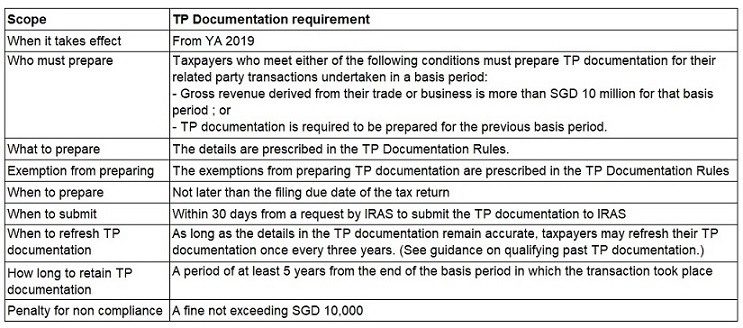

For RPT above the threshold (per financial year), the company must maintain a transfer pricing documentation as an evidential document that the company adopts the arm’s length principle in all RPT.

The TP documentation should be written in English and serves to demonstrate the compliance with the arm’s length principle.

The company should retain the TP documentation for five (5) years.

What are the Transfer Pricing documentation requirements?

The changes in the TP documentation take effect from year of assessment 2019 (i.e. for the financial year ending in the calendar year 2018).

Should you need assistance or would like to find out more about tax services in Singapore, please send through your enquiry via Contact for our team to understand exactly what concerns you have.

The Company tax team will contact you to discuss this in detail.