Below is some essential information for Singapore companies on Tax Services.

1. Singapore Corporate Income Tax (CIT)

The company’s income for the preceding financial year is the income for a particular Year of Assessment (YA).

For example:

The company closes its financial year on 31 December 2020. Its taxable income for YA 2021 is from 1 January 2020 to 31 December 2020. ECI is due for filing on 31 March 2021 and final tax returns are due for filing on 30 Nov 2021.

The company closes its financial year on 31 March 2020. Its taxable income for YA 2021 is from 1 April 2019 to 31 March 2020. ECI is due for filing on 30 June 2020 and final tax returns are due for filing on 30 Nov 2021.

The prevailing corporate tax rate is 17.0%.

2. Key dates to take note for submission of Tax Forms to IRAS

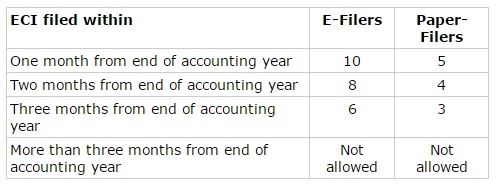

a. The company must submit the Estimated Chargeable Income (ECI) within three months from the company’s financial year-end.

b. The company must submit Form C or Form C-S by 30 November of every year. If the company opts for e-filing, the due date is on 15 December.

3. All Singapore companies must maintain documentary records for five years

The company must maintain a proper and robust system to keep the documentary records of its business transactions during the financial year.

Business records are source documents i.e. sales invoices, receipts, payment vouchers, bank statements, bank-in slips, general ledgers and other forms of documentary records that support the occurrence of related business transactions during the financial year.

The company must keep these business records for at least five years from the relevant Year of Assessment and be retrievable upon request by IRAS.

For example, for YA 2021 (i.e. the financial year from 1 January 2020 to 31 December 2020), the company must keep business records up to 31 December 2025 (i.e., five years).

For transfer pricing documentation, please refer to Transfer Pricing Guidelines For Singapore Companies.

4. Submission of Annual Tax Forms to IRAS

Estimated Chargeable Income (ECI)

Estimated Chargeable Income (ECI) is the company’s estimated income after deducting tax allowable expenses for the preceding financial year.

For example:

The company’s first financial year end is on 31 December 2020. The company must submit its ECI for the financial year ended 31 December 2020 to IRAS by 31 March 2021.

The company’s first financial year end does not fall on 31 December, the company must submit the “Notification of New Financial Year End” to IRAS.

IRAS Income Tax Forms – Form C and Form C-S

There are two type of tax forms – Form C and Form C-S. To qualify to file Form C-S, a Singapore incorporated company must fulfil all the following criteria:

1. The company has an annual revenue of SGD 1 million or less;

2. The company only derives taxable income at the corporate tax rate; and

3. The company does not claim carry-back relief, group relief, investment allowance, research and development tax allowance, foreign tax credit and tax deducted at source.

For filing Form C-S, there are no requirements to file financial statements, tax computations and supporting schedules unless requested by IRAS.

If your company does not qualify to file Form C-S, the company must file Form C, together with financial statements, tax computations and supporting schedules to IRAS. All companies must also declare their actual income or losses in the corporate income tax form annually.

Please note that IRAS takes a serious on late filing or non-filing of income tax form.

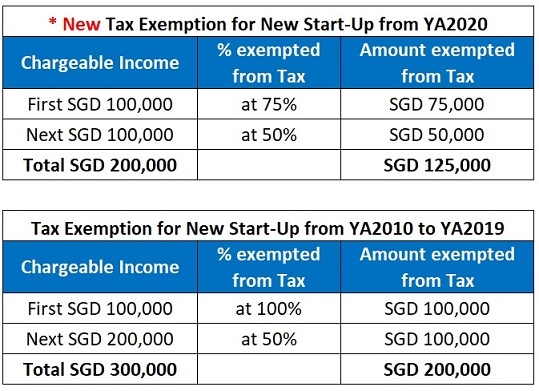

5. Tax exemptions for Singapore Companies

For the first three consecutive Year of Assessments, qualifying companies can enjoy tax exemption as follows.

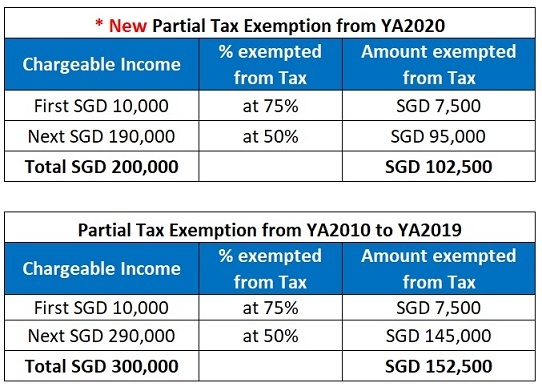

All Singapore companies can enjoy partial tax exemption unless the companies have already claimed the Tax Exemptions for New Start-Up Companies.

Expenses Incurred Before the Commencement of Business

The company can claim a tax deduction for operating expenses incurred one year before the first day of the financial year against its operating revenue.

In general, all business-related expenses incurred after the commencement of the company’s business are tax-deductible.

Capital Allowances

The company can claim capital allowances deduction on fixed assets – purchased and used in the business.

6. Company’s responsibilities to report all employees’ annual earnings (IR8A)

The company is required to issue a statement of remuneration to every employee before 1 March of every year.

All employees must file their personal tax return before 15 April of every year.

7. Tax reporting requirements for Dormant Companies

For dormant companies, please read Managing taxes for dormant companies.

Contact Company Tax Team

Please send through your enquiry via Contact for our team to understand exactly what concerns you have.

The Company Tax team will contact you to discuss the tax questions you have for your companies.